Jan 30., 2019 / Customer Success Excellence

2018 CSPI™ Benchmark Survey

Our Customer Success Performance Index™ (CSPI) combines our experiences of building and improving Customer Success for multiple companies from early startups to F100 companies.

Over 100 companies participated in the global 2018 CSPI Benchmark Survey and established a reference baseline for operational performance measured by Net Revenue Retention (NRR). It also established the high correlation between high NRR and high scores in the CSPI framework, proving the relevance of the framework as an operational guide for Customer Success leaders.

The Customer Success Performance Index™

The CSPI has eight core dimensions that are relevant for high Net Revenue Retention in a Customer Success – centric company

- Alignment: Where is CS in the organization and how it influences corporate processes and policies

- Team: The services and capabilities the CS team provides

- Segmentation: How are customers viewed

- Playbook: What is included in your playbook and it’s used

- Resources: Resources that you provide for your customer’s success

- Onboarding: How are you helping your customer to ramp up to full productivity

- Relationship: Your customer engagement model

- ROI: How and when do you demonstrate that your solution generates value

Depending on your realization of Customer Success you can achieve up to 100 points in each dimension, or 800 points in total.

CSPI Survey Observations

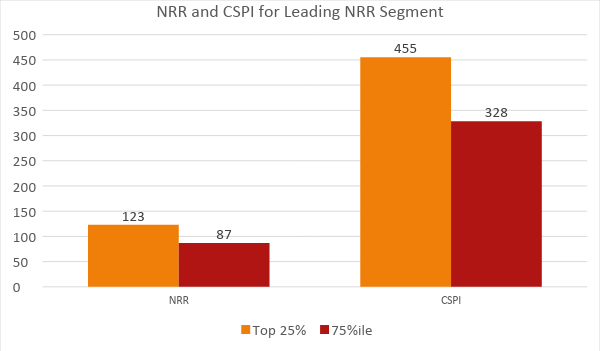

The results from the 2018 CSPI Benchmark survey of over 100 companies prove the strong correlation between NRR and CSPI score. The top 25% performing businesses as measured by NRR are also scoring very high in the CSPI. The graph below shows how the average NRR and CSPI are for both the top 25% as well as the 75 percentile. This is in line with Alex Clayton’s analysis of recent IPO’s analysis of recent IPO’s and his calculated average NRR of 117%.

Figure 1: NRR and CSPI performance for leading businesses

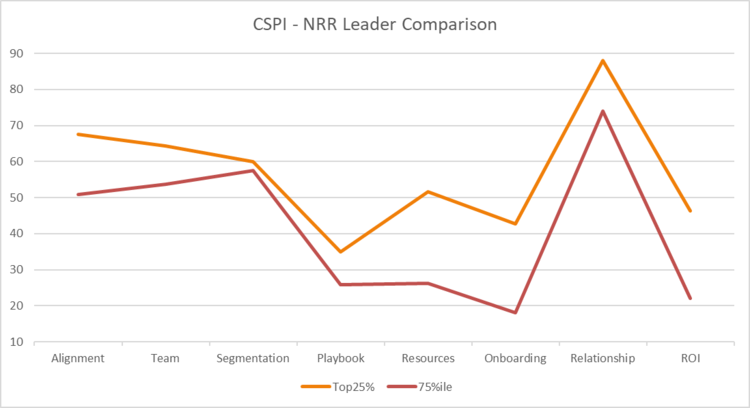

A closer look reveals the four dimensions where the top NRR producers distinguish themselves: Alignment, Resources, Onboarding and ROI. The graph below underlines the statistical correlation between NRR and high scores in these dimensions.

Figure 2: NRR Leaders and CSPI Adoption

Here are some of the best practices these leaders adopted:

- Sales, Engineering and Marketing decisions are influenced by Customer Success as are the compensation plans for these functions.

- Channel partners adhere to the same customer journey: They use the same playbooks, measure the same interactions and communicate with customers in the same way as the internal Customer Success team.

- Implementation and onboarding partners use the same best practices and materials.

- Predictive analytics captures ROI-based metrics to detect highly successful and struggling customers as compared to segment-specific baselines.

International Variances

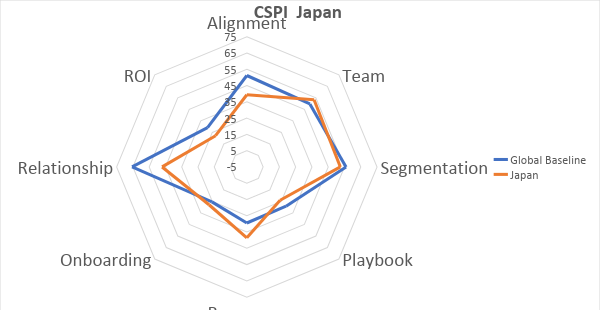

The participating companies are from the US, the UK, New Zealand and Japan. Comparison by country showed no significant differences except for Japan. In average the Net Revenue Retention is 8% lower as for the other countries combined. The CSPI score is also lower by 51 points. These are however just the averages. Multiple Japanese participants are among the NRR and CSPI leaders.

Figure 3: CSPI Score in Japan

My discussions with Hiroko Otsu from Success Lab and Japanese business leaders indicate that the adoption of Customer Success in Japan is not yet as strong, which is confirmed by the CSPI benchmark results.

The higher Team score is rooted in the Japanese business culture of hiring generalists who can do it all. This leads to strong relationships between the CSM and customer stakeholders as “one throat to choke”. On the other hand, dedicated core competencies for specific segments or service needs are less developed.

The strength in the Resources dimension underlines that dedicated resources that manage the creation of resources from communities to guides to webinars are more prevalent at Japanese companies than elsewhere.

I look forward to the 2019 results to see, how more Japanese companies close the gaps.

Where to next

For companies in the 75 percentile the Top 25% describe the path to growth:

Improve the internal alignment within your company. Customer Success has over time the responsibility to preserve and expand the largest revenue stream for a company. To support this retention and growth a company should

- Assure high solution match to avoid unsuccessful rescue attempts and high resource drains from companies with a low solution fit. With average payback periods of 30 months, these customers only eat up profits

- Enable the continued success of your customer base by removing usability obstacles in the product, services and resources provided.

- Document a standardized customer journey that is followed by all departments and your sales and SI partners

- Increase adoption with dedicated onboarding and implementation resources and services

- Measure and predict value and risks and have dedicated playbooks for “the Good”, “The Normal” and “The Ugly”.

- Communicate the value to your customers to empower decision makers to invest in a common future

Interestingly the path for the Top 25% is identical. While they lead the charge already, the identical dimensions have potential for improvement, when compared to the strong internal Alignment and Relationships already in place. Leveraging the set of metrics and analytics, the efficacy of specific iterative improvements and the profitability gain of these improvements should be measured to find the optimum balance between customer delight and customer profitability.

. . . . .

In subsequent blog posts three of the best performing CS executives in our benchmark survey will share with us what they did to achieve high CSPI scores:

Lauren Costella @ Medrio achives excellence Alignment, Relationships and ROI

Sue Farrance @ Signable creates strong relationships with great Playbooks and Onboarding

Genshin Maruta @ Abeja achieves high NRR through innovative Segmentation, Customer Journey and Proving Success

Enjoy learning from these exceptional Customer Success leaders or take your own personalized CSPI assessment,

Andreas.

LEAVE A REPLY

You must be logged in to post a comment.