2019 CSPI Benchmark Survey

For the second year in a row, the Customer Success community responded to our call to action and benchmarked themselves against their peers and the proven Customer Success Performance Index™ (CSPI).

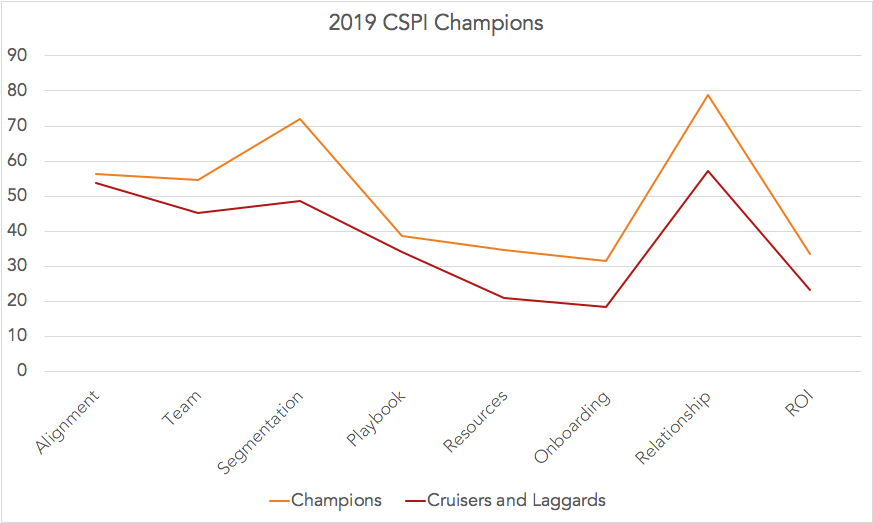

The CSPI became more challenging in 2019, incorporating new best practices into the framework. Our Champions, or top 25% of respondents, responded to this challenge with an increased Net Revenue Retention Rate (NRR), rising to 140% compared to 123% in 2018. NRR remained the same for the remainder of the field at 86%, which equals a loss of half their subscription revenue within five years.

The Customer Success Performance Index™

As a refresher, the Customer Success Performance Index™ (CSPI) combines the experience of building and improving Customer Success for now over 200 companies from early startups to F100 companies. The 2018 benchmark survey established a clear correlation between high Net Revenue Retention and high scores in the eight dimensions of the CSPI:

1. Alignment: Where is CS in the organization and how it influences corporate processes and policies

2. Team: The services and capabilities the CS team provides

3. Segmentation: How are customers viewed

4. Playbook: What is included in your playbook and it’s used

5. Resources: Resources that you provide for your customer’s success

6. Onboarding: How are you helping your customer to ramp up to full productivity

7. Relationship: Your customer engagement model

8. ROI: How and when do you demonstrate that your solution generates value

2019 Benchmark Survey Results

The increase of Net Revenue Retention Rates for 2019 from 123% to 140% demonstrates how Customer Success Champions are absorbing the collective best practices and have the support of their executive team and peers to instill a corporate-wide culture of Customer Success.

Looking deeper into the eight dimensions, and comparing against last year’s results, a few differences and trends emerge:

The gap in the Alignment dimension disappeared. This is a testimony to the widespread acceptance of Customer Success as a business model, and not just a fad.

While Outcome is now part of the common CS vernacular, Outcome-centric Segmentation across the entire company is not yet the common approach, and less so how data from each segment is used to craft messaging, convert leads, and shape a customer journey with Playbooks, Resources, and Onboarding to launch new customers on a voyage of Long-Term Value (LTV).

For our Champions, the customer engagement doesn’t stop here. As mainstream customers expect from a trusted advisor, a strong and active Relationship continues after the initial Implementation and Adoption stages and provides valuable insights to each stakeholder on maximizing their ROI.

International Differences were not noticeable in this year’s benchmark. Congratulations to our Japanese Customer Success leaders, who managed to close any gaps we observed last year.

Where to Next

If you haven’t done so yet, compare your performance against your peers and see in which dimensions you may find a potential to improve your operational top and/or bottom line. The CSPI provides both the rigor of a best practice and the freedom to apply what fits best into your customer engagement model, processes, and industry.

As a global trend for the CSPI for 2020, the focus on Net Profits will intensify as will our focus on Non-Software subscriptions, Advanced Analytics and Machine Learning.

. . . . .

Continued Success for 2020 and Beyond,

Andreas

The Journey to Operational Excellence: Customer Success from Early Teams to Mature Operations

Customer Success in a company has its own journey: It often starts with a team of generalists who are measured by Logo Retention. Over time this team transforms into many specialized functions who pay close attention to micro-segments and build predictive models to maximize profitability.

Compare your organizations against the four stages of Generalize, Standardize, Specialize, and Optimize.

GENERALIZE

When you start with Customer Success, the corporate focus is typically on Logo Retention and referenceability, preserving the precious wins that Sales and Marketing moved through during your sales process. In order to keep your customers as happy and productive as possible, your CSMs bend over backwards and respond to a wide spectrum of customer needs. Your CSMs often play several roles, while in parallel the exact customer journey, roles, processes, templates, and approaches, are still in flux.

While each CSM is a hero in their own right, the lack of best practices leads to inconsistency, confusion, and frustration. Furthermore, account ownership is not well defined and the Sales team remains very active in the account. It is common and acceptable that all customer data resides in the CRM system.

The challenge for each CS leader is when to move from this state to the Specialize stage. In several cases when I was asked to help, the team was stuck as they tried to scale the team without improving the processes based on the existing experiences.

Customer Example: I consulted with this startup who recently closed their Series B funding and had a larger CS team that recently split into CSMs, Onboarding, and Support. However, the three teams continuously helped the same customers with day-to-day activities. The customer experience looked like a broken record stuck in Onboarding. The stress level and demand on the team were at record heights. After fixing some immediate issues, I recommended getting the teams on the same page; the CS team, execs included, were sent back to school to establish a common vocabulary and understanding of the various interactions. With this intellectual foundation in place, the standardization of a customer journey and the supporting playbooks and processes are now easy and they are progressing to the Specialize Phase.

STANDARDIZE

With actual data from your customers in hand, you and your team can discern common patterns across CSMs and customers and align accordingly:

- Specific sets of customer outcomes

- The common phases of the customer’s journey

- Playbooks for specific customer journey phases and desired outcomes

- Specific roles for implementation, training, support, account management

- Strengths within the team along with these roles

With standard processes, you can now move core functions from your CRM system into a dedicated CS platform and automate and templatize common functions. A knowledgebase for your CS team, customers, and partners is constantly growing with new insights.

Operational focus turns from Logo Retention to Net Revenue Retention and your Customer segmentation from verticals to outcomes.

Customer Example: I faced this situation at one startup I lead and transformed Customer Success. Many individual heroes, not much standardization and ability to scale and grow. Over time I established standardized processes and a common platform. The efficiency within the team doubled and Time-to-Value was cut in half.

SPECIALIZE

As you cross the chasm into the mainstream market, your customers expect “The Full Experience.” In addition to Professional Services, Training, Support, and Account Management you might add specialized internal and external capabilities to assist your CSMs and customers. Examples of this might look like:

- Solution architects provide deep domain expertise and integration knowledge

- A creative team generates content from onboarding materials in various forms to how-to’s, solutions briefs, and executive briefs.

- Your community manager cares for the physical and virtual customer community

- A knowledge manager develops and executes a strategy to collect, maintain, and share collective wisdom within the team, company, and customers.

- Partner manager enlists and supports external resources. Fully integrated system integrator and channel partners provide an identical seamless customer experience, wherever you decide to split the responsibilities between Sales, Implementing, Nurture, and Renewal.

- An operations manager ensures that the data integration between the CSM, CRM, Professional Services Automation, Support, Marketing, and Finance systems is tight.

Most companies I worked with close or past an IPO at this stage, and with the quarterly financial due diligence the operational focus shifts from Net Revenue Retention to Net Profitability.

Customer Example: I built a CS team from scratch of 70+ for this $1B+ software company. Instead of 70+ clones, I established an entire set of primary and secondary core competencies and maximized business value for several Fortune 500 companies and our Net Revenue Retention. With our designated domain experts I added premium services, increased Annual Recurring Revenue by 15% and customer loyalty by double digits.

OPTIMIZE

By now all the low-hanging fruit is gone. With a large customer base, you can now start to experiment on micro-segments and assess. If a different or simplified approach leads to the same Net Revenue Retention without putting a large amount of revenue in your portfolio at risk and find the optimum balance between maximizing customer value and profits (See also: Stop Delighting Your Customers).

With enough customer history in hand, you are able to benchmark your customers. As described in Leverage your Champions, top-performing customer champions serve as a role model for the majority to follow. You can now contemplate what the correct action is for those customers who are falling behind: Rescue, Recover or Farewell and fine-tune your operations and bottom line.

Example: The Customer Success Performance Index™ is a predictive model for Net Revenue Retention. The 2019 benchmark survey proved the correlation between our reference model of excellence and best-in-class NRR and over 200 companies benefited thus far.

NEXT STEPS

If you are interested in a more detailed comparison of your organization against over 200 companies, you can take the Customer Success Performance Index™ benchmark survey or contact us for a personalized engagement.

A Tale of Two EBRs

How to orchestrate the ideal EBR and what not do do.

CSPI Excellence Blog – Genshin Maruta @ Abeja

Today’s blog post features Genshin Maruta, the Head of Customer Success for Abeja in Japan. With the help of Hiroko Otsu at Success-Lab Japan, who extended the 2018 survey to Japan, he was able to measure his performance and achieved one of the highest CSPI benchmark scores and Net Revenue Retention rates. Congratulations to Gen and his team!

CSPI Excellence Blog – Sue Farrance @ Signable

Sue Farrance, teh head of CS @ Signeable, shares how she achieved Customer Success excellence through strong internal alignment, adaptable playbooks and intuitive onboarding.

CSPI Excellence Blog: Lauren Costella @ Medrio

Lauren Costella, VP of CS @ Medrio, achieved the highest CSPI score and one of the highest NRR rates. Here are some glimpses into Medroi’s exceptional Customer Success program.

2018 CSPI™ Benchmark Survey

Over 100 companies participated in the global 2018 CSPI Benchmark Survey and established a reference baseline for operational performance measured by Net Revenue Retention (NRR). It also established the high correlation between high NRR and high scores in the CSPI framework, proving the relevance of the framework as an operational guide for Customer Success leaders.