Tuning Tips Episode 11 – Managing Meaningful Relationships

Ziv Peled, Customer Relationship Ninja shares how to build meaningful relationships with key stakeholder as the final segment of our Tuning Tips series.

Listen to the episode at https://www.youtube.com/watch?v=bL-8J9rUVU8.

Tuning Tips Episode 10 – Segmenting by Outcomes

Jan Young shares why outcome-based segmentation is a cornerstone of why Champions achieve 28%higher Net Revenue Retention.

Listen to the episode at https://www.youtube.com/watch?v=vA4Ycdouw90.

Tuning Tips Episode 9 – CS Services

Lauren Costella, CS Mega Evangelist shares with us, how Champions achieve 28% higher NRR with dedicated services from Onboarding to Marketing out of CS.

Listen to the episode at https://www.youtube.com/watch?v=jc2evRyu-n8.

Tuning Tips Episode 8 – Customer Experience and NPS

Learn from Customer Success guru Shreesha Ramdas, SVP and GM at Medallia, how the Champions leverage NPS and Customer Experience to achieve 28% higher Net Revenue Retention.

Listen to this episode at https://www.youtube.com/watch?v=vJwE_A3h5_s.

Tuning Tips Episode 7 – Benchmarking your Customers

Learn from CS guru Irit Eizips how to achieve 28% higher Net Revenue Retention by benchmarking your customers.

Listen to the episode at https://www.youtube.com/watch?v=Z4D7w253a6o.

Tuning Tips Episode 6 – Customer Outreach

In this episode of Tuning Tips, Laura Lakhwara shares with us how she reaches out to customers to build meaningful relationships, one of the cornerstones that Champions use to achieve 28% higher Net Revenue retention.

Listen to the episode at https://www.youtube.com/watch?v=OwMnoD3f5uY.

Tuning Tips Episode 5 – Predictive Analytics

Learn from Prithwi Dasgupta, the CEO of SmartKarrot, how to leverage predictive analytics in the same way as the Champion companies, which achieve 28% higher Net Revenue Retention.

Listed to the episode at https://www.youtube.com/watch?v=wrhcnx1m7C4.

Tuning Tips Episode 4 – Paid Professional Services

Learn from the Champion companies how they achieve 28% higher NRR with distinct best practices, including offering Paid Professional Services. Naval Gupta, ProServ leader at Github, brings this factoid to life with his experience.

Listen to the episode at https://www.youtube.com/watch?v=GJuwGtxb4lE.

Tuning Tips Episode 3 – Standardized Playbooks and Processes

In this episode of Tuning Tips, Shari Srebnick shares how standardized Customer Success processes and playbooks enable Champions to achieve 28% higher Net Revenue Retention.

Find out what it takes to become such a Champion!

Listen to the episode at https://www.youtube.com/watch?v=i4PxXb7ASn0

Tuning Tips Episode 2 – Must Have Customer Resources

Learn from Jeff Heckler how Champions achieve 28% higher Net Revenue Retention. Today we discuss with Jeff Heckler how customer resources like a helpdesk, health checks and such increase your subscription renewals. Find out what it takes to become such a Champion!

Listen to the episode at https://www.youtube.com/watch?v=kyFj6mTBok0

Tuning Tips Episode 1 – Owning the Customer

Kristen Hayer and I are kicking off Tuning Tips by CSTuners! We will end the discussion if Customer Success should own Renewals and Upsell by following the best-in-class companies, who achieve 28% higher Net Revenue Retention. Find out what it takes to become such a Champion!

Listen to the episode at https://www.youtube.com/watch?v=AGzwJr0vYKw

Own the Commercial Relationship

My recent podcast on Inbenta’s Customer Experience blog touched on

- Promoting CS inside your organization: Own the commercial relationship

- Focusing limited resources: Assess if an issue is caused by us, tothetger, or by them and act accordingly

- AI in CS: This will be standard in CS platforms in a few years

- Listen to the entire episode at Inbenta podcast

User Adoption Podcast

I was honored to take parts in Henrik De Gyor’s User Adoption Podcast and speak about the importance of widespread user adoption as a first leg in a customer journey to long-term customer success.

The podcast is available here: https://useradoptionpodcast.com/2020/08/03/andreas-knoefel/

Sales Won’t Save You This Time Around

With soaring unemployment rates, the post-COVID recession will be the third in my professional life after the dot.com bubble in 2001 and the housing bubble in 2009 burst. Both times the strategy was:

Hire Sales and Sell, Sell, Sell, whatever it takes.

This will not work this time around. Instead, I show you how to maximize your profits, tune your operations and boost your customers in your quest to survive this recession.

Maximize Your Profits

Prior recession survival strategies were built around perpetual licensing, where the bulk of the customer Lifetime Value (LTV) was tied to the initial purchase. Sales was King, Marketing as a lead-gen engine, and Engineering to hotwire all these new “features” for new prospects, had relative job security. Post Sales in particular and every other department to some extent got the boot.

In this new XaaS world, Sales is not the Most Profitable Player any more. Looking at the Customer Acquisition Cost (CAC) ration for various events during the customer lifecycle 1,2:

Acquiring a new customer requires investment, as the Sales&Marketing expenses to generate, qualify and close a new deal take time to come to fruition, which your company can’t afford when Cash-Now is King.

Upsell and Expansion are also not very likely, unless your customers are in a growth market such as Lab equipment and services or Personal Protective Equipment (PPE).

That makes the Customer Success Managers (CSM) who nurtures and renews each existing contract the new champions. And the team supporting the CSM’s is the Product team, while Marketing has lost its job security and will contract with the rest of the company.

The equation has shifted in the favor of Customer Success as the foundation of your cash-preserving and cost-cutting strategy. The next step is now to ensure that your CS team is humming at peak performance and maximizes the existing subscription base to its fullest.

Tune Your Operations

As you are fighting for survival and look for any reason to cut costs, so do your customers and renewals are nothing but automatic. Proving a tangible business benefit as increased profits or reduced costs (ROI), not some esoteric outcome, is ever more important for the CSM’s. This is more than a single task and requires efforts in multiple dimensions.

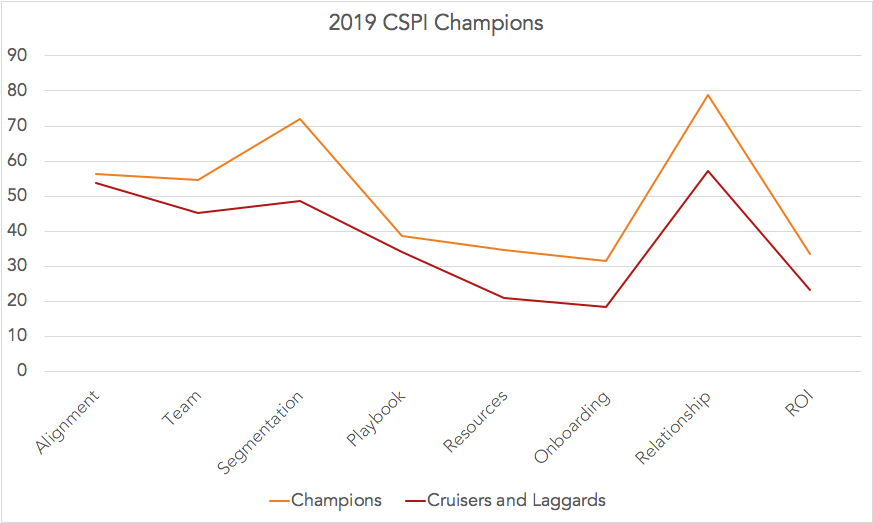

Here is a look at the 2019 participants in the annual Customer Success Performance Index™ (CSPI) benchmark. The top 25% Businesses with the best-in-class Net Revenue Retention (NRR) with a NRR of 140 vs 87 for the rest of the field also score significantly higher in the adoption of the CSPI best practices in basically every dimension.

Figure 1: Best-in-Class NRR Champions use best practice Customer Success

In order to support such a strong ROI, outcome-centric Segmentation, a mutually developed customer journey with solid Playbooks, customer Resources and Implementation and Onboarding services that accelerate Time-to-Value build the foundation for a nurturing customer Relationship built on ROI.

If you would like to compare yourself against your peers, spend 8-10 minutes to complete the CSPI benchmark survey and receive your individual benchmark report and valuable tips on how to fine-tune your CS Operations.

Boost Your Customers

Even better than preserving the customer ROI is maximizing said ROI. I prefer a benchmarking strategy that fosters Champions others can follow.

By looking at what actually works, not what should work best, you are taking a customer-centric view of reality and have real-time stories to tell. This is different from building references, where you are looking for the most recognizable logo, biggest contract or other superlatives you can find. While those criteria are important, they ignore how demanding the engagement with those accounts may be.

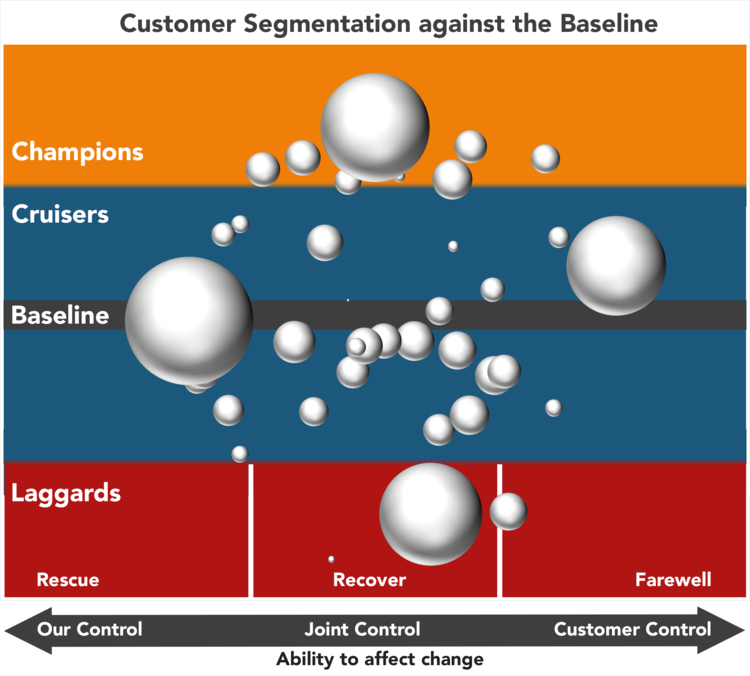

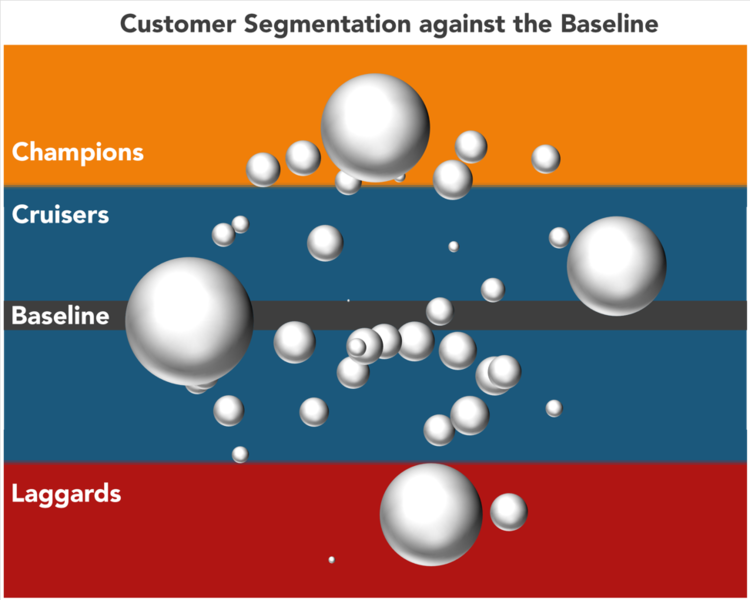

Instead I develop a baseline, find the Champion customers who excel and replicate their example with the bulk of your customers who Cruise along, and decide how to support Laggards, who may cost you more than it’s worth.

Setting the Baseline

Look at your existing customers and find what their typical customer journey looks like. What are the use-cases, how long is the implementation, how fast are users onboarding, and how quickly do they reach the desired ROI.

Benchmark Your Customers

Against this baseline I define three types of customers: Champions, Cruisers, and Laggards. Each type has different playbooks:

Figure 2: Customer Segmentation against your Baseline

Champions: At the top are my dream customers: they exceed all expectations, accelerate their onboarding, use all the bells&whistles AND surpass their business value targets. These are my champions and deserve dedicated attention:

a) I celebrate their achievements as publicly as possible: press releases, keynote speaker engagements, webinars, reference calls, innovation awards. For those who cannot be named publicly we have an internal celebration to acknowledge the sponsor and other core members.

b) I synthesize their unique “essence”: Did they have a higher-level executive sponsor, is their IT very nimble, are they integrated with SoftwareX, etc. This knowledge is priceless for our lead qualification and Sales plays, our best-practice knowledge base, and playbooks.

c) They form my customer council. They already pushed the boundaries of our solution and were ready for more. Their proposals drive innovation, and they are motivated to adopt the new capabilities. They support the marketing of these enhancements as our vocal advocates.

I create a reference model for other customers and users to follow. Whoever is not in your top layer may want to get there, and now I and my team can guide them together to win the pot of gold at the end of the rainbow.

Cruisers: Hopefully the majority of your customers achieve (most of) the expected business value within the expected timeframe. These customers are on a stable course and perfect targets to point to model themselves after a Champion who is a close fit to their ROI business outcomes , culture and industry.

The Laggards who struggle to keep up, I further break down into Rescue, Recover, and Farewell, based on whether the ability to affect change is mainly on ourselves, joint, or with the customer.

Rescue

The first set of Laggards fell behind due to issues caused by us which significantly hinders their ability to achieve the agreed upon ROI. If the root cause are product issues, the Engineering team is on call. If the issue is mis-configuration or mis-use, the implementation and onboarding team is on call to get the customer back on the success track.

Recover

In the joint control category are accounts where the customer and the account team defined the business goals and timeline overly optimistic. What looked great at the beginning of the customer journey may not have considered some issues along the way. Adjusted ROI targets and more realistic Time-to-Value still create a positive ROI and stabilize these customers, before you look after promoting them to a Champion.

Farewell

“You can lead a horse to the water, but …” is a fitting catch phrase for these customers. The key to their success or failure is in their hands. Maybe they are lacking or lost executive sponsorship, maybe their champion is not influential enough, or their tools, processes or integration links are not at the required level. Worst of all is a bad solution fit, because their vision or expectations are not aligned with your actual product scope and mutually agreed upon goals.

In particular with a heightened emphasis on frugality you should spend any resources on these customers with caution. They may not be worth the effort and a hard look is warranted instead of an all-out rescue effort to preserve every logo you have. This is not about a lack of caring, this is hard reality. If those customers stay with minimal effort, ok: if they churn, wish them well.

Here is the updated Customer segmentation with the strategy details for Laggards.

Figure 2a: Customer Segmentation with Champions, Cruisers and Laggards

. . . . .

Armed with your updated recession survival playbook to maximize your profits emphasizing subscription renewals, tuning your Customer Success operations and boosting your customers to new Champion levels you are better equipped to weather this recession than betting on the comparatively costly investment into new Sales.

I hope that you succeed and wish you safety, health and prosperity.

2019 CSPI Benchmark Survey

For the second year in a row, the Customer Success community responded to our call to action and benchmarked themselves against their peers and the proven Customer Success Performance Index™ (CSPI).

The CSPI became more challenging in 2019, incorporating new best practices into the framework. Our Champions, or top 25% of respondents, responded to this challenge with an increased Net Revenue Retention Rate (NRR), rising to 140% compared to 123% in 2018. NRR remained the same for the remainder of the field at 86%, which equals a loss of half their subscription revenue within five years.

The Customer Success Performance Index™

As a refresher, the Customer Success Performance Index™ (CSPI) combines the experience of building and improving Customer Success for now over 200 companies from early startups to F100 companies. The 2018 benchmark survey established a clear correlation between high Net Revenue Retention and high scores in the eight dimensions of the CSPI:

1. Alignment: Where is CS in the organization and how it influences corporate processes and policies

2. Team: The services and capabilities the CS team provides

3. Segmentation: How are customers viewed

4. Playbook: What is included in your playbook and it’s used

5. Resources: Resources that you provide for your customer’s success

6. Onboarding: How are you helping your customer to ramp up to full productivity

7. Relationship: Your customer engagement model

8. ROI: How and when do you demonstrate that your solution generates value

2019 Benchmark Survey Results

The increase of Net Revenue Retention Rates for 2019 from 123% to 140% demonstrates how Customer Success Champions are absorbing the collective best practices and have the support of their executive team and peers to instill a corporate-wide culture of Customer Success.

Looking deeper into the eight dimensions, and comparing against last year’s results, a few differences and trends emerge:

The gap in the Alignment dimension disappeared. This is a testimony to the widespread acceptance of Customer Success as a business model, and not just a fad.

While Outcome is now part of the common CS vernacular, Outcome-centric Segmentation across the entire company is not yet the common approach, and less so how data from each segment is used to craft messaging, convert leads, and shape a customer journey with Playbooks, Resources, and Onboarding to launch new customers on a voyage of Long-Term Value (LTV).

For our Champions, the customer engagement doesn’t stop here. As mainstream customers expect from a trusted advisor, a strong and active Relationship continues after the initial Implementation and Adoption stages and provides valuable insights to each stakeholder on maximizing their ROI.

International Differences were not noticeable in this year’s benchmark. Congratulations to our Japanese Customer Success leaders, who managed to close any gaps we observed last year.

Where to Next

If you haven’t done so yet, compare your performance against your peers and see in which dimensions you may find a potential to improve your operational top and/or bottom line. The CSPI provides both the rigor of a best practice and the freedom to apply what fits best into your customer engagement model, processes, and industry.

As a global trend for the CSPI for 2020, the focus on Net Profits will intensify as will our focus on Non-Software subscriptions, Advanced Analytics and Machine Learning.

. . . . .

Continued Success for 2020 and Beyond,

Andreas

The Journey to Operational Excellence: Customer Success from Early Teams to Mature Operations

Customer Success in a company has its own journey: It often starts with a team of generalists who are measured by Logo Retention. Over time this team transforms into many specialized functions who pay close attention to micro-segments and build predictive models to maximize profitability.

Compare your organizations against the four stages of Generalize, Standardize, Specialize, and Optimize.

GENERALIZE

When you start with Customer Success, the corporate focus is typically on Logo Retention and referenceability, preserving the precious wins that Sales and Marketing moved through during your sales process. In order to keep your customers as happy and productive as possible, your CSMs bend over backwards and respond to a wide spectrum of customer needs. Your CSMs often play several roles, while in parallel the exact customer journey, roles, processes, templates, and approaches, are still in flux.

While each CSM is a hero in their own right, the lack of best practices leads to inconsistency, confusion, and frustration. Furthermore, account ownership is not well defined and the Sales team remains very active in the account. It is common and acceptable that all customer data resides in the CRM system.

The challenge for each CS leader is when to move from this state to the Specialize stage. In several cases when I was asked to help, the team was stuck as they tried to scale the team without improving the processes based on the existing experiences.

Customer Example: I consulted with this startup who recently closed their Series B funding and had a larger CS team that recently split into CSMs, Onboarding, and Support. However, the three teams continuously helped the same customers with day-to-day activities. The customer experience looked like a broken record stuck in Onboarding. The stress level and demand on the team were at record heights. After fixing some immediate issues, I recommended getting the teams on the same page; the CS team, execs included, were sent back to school to establish a common vocabulary and understanding of the various interactions. With this intellectual foundation in place, the standardization of a customer journey and the supporting playbooks and processes are now easy and they are progressing to the Specialize Phase.

STANDARDIZE

With actual data from your customers in hand, you and your team can discern common patterns across CSMs and customers and align accordingly:

- Specific sets of customer outcomes

- The common phases of the customer’s journey

- Playbooks for specific customer journey phases and desired outcomes

- Specific roles for implementation, training, support, account management

- Strengths within the team along with these roles

With standard processes, you can now move core functions from your CRM system into a dedicated CS platform and automate and templatize common functions. A knowledgebase for your CS team, customers, and partners is constantly growing with new insights.

Operational focus turns from Logo Retention to Net Revenue Retention and your Customer segmentation from verticals to outcomes.

Customer Example: I faced this situation at one startup I lead and transformed Customer Success. Many individual heroes, not much standardization and ability to scale and grow. Over time I established standardized processes and a common platform. The efficiency within the team doubled and Time-to-Value was cut in half.

SPECIALIZE

As you cross the chasm into the mainstream market, your customers expect “The Full Experience.” In addition to Professional Services, Training, Support, and Account Management you might add specialized internal and external capabilities to assist your CSMs and customers. Examples of this might look like:

- Solution architects provide deep domain expertise and integration knowledge

- A creative team generates content from onboarding materials in various forms to how-to’s, solutions briefs, and executive briefs.

- Your community manager cares for the physical and virtual customer community

- A knowledge manager develops and executes a strategy to collect, maintain, and share collective wisdom within the team, company, and customers.

- Partner manager enlists and supports external resources. Fully integrated system integrator and channel partners provide an identical seamless customer experience, wherever you decide to split the responsibilities between Sales, Implementing, Nurture, and Renewal.

- An operations manager ensures that the data integration between the CSM, CRM, Professional Services Automation, Support, Marketing, and Finance systems is tight.

Most companies I worked with close or past an IPO at this stage, and with the quarterly financial due diligence the operational focus shifts from Net Revenue Retention to Net Profitability.

Customer Example: I built a CS team from scratch of 70+ for this $1B+ software company. Instead of 70+ clones, I established an entire set of primary and secondary core competencies and maximized business value for several Fortune 500 companies and our Net Revenue Retention. With our designated domain experts I added premium services, increased Annual Recurring Revenue by 15% and customer loyalty by double digits.

OPTIMIZE

By now all the low-hanging fruit is gone. With a large customer base, you can now start to experiment on micro-segments and assess. If a different or simplified approach leads to the same Net Revenue Retention without putting a large amount of revenue in your portfolio at risk and find the optimum balance between maximizing customer value and profits (See also: Stop Delighting Your Customers).

With enough customer history in hand, you are able to benchmark your customers. As described in Leverage your Champions, top-performing customer champions serve as a role model for the majority to follow. You can now contemplate what the correct action is for those customers who are falling behind: Rescue, Recover or Farewell and fine-tune your operations and bottom line.

Example: The Customer Success Performance Index™ is a predictive model for Net Revenue Retention. The 2019 benchmark survey proved the correlation between our reference model of excellence and best-in-class NRR and over 200 companies benefited thus far.

NEXT STEPS

If you are interested in a more detailed comparison of your organization against over 200 companies, you can take the Customer Success Performance Index™ benchmark survey or contact us for a personalized engagement.

Recover, Rescue, or Farewell?

In the previous article on Leveraging your Champions I described how to detect, nurture and leverage your customer Champions to increase adoption, expansion, and ARR across the entire customer portfolio. Not everyone can or will be a Champion, and many customers become Cruisers; customers who are comfortable enough where they are to come back year after year to renew. However, at the other end of your spectrum, you have customers who are lagging behind the general expectations, hold the highest churn risk, and warrant a closer look. In this age of customer experience, NPS and other satisfaction measures we want to help all of them, but in reality, some are time sinks and money drains that are not worth the effort.

Over the years I developed three strategies for Laggards, called Rescue, Recover, and Farewell, based on whether the effort to change is mainly on ourselves, shared, or on the customer.

RESCUE

In my experience, there are typically less than five issues that are “mission-critical.” The best way out of such a crisis is a realistic plan. General platitudes and unsubstantiated assurances will cost you the last bits of trust you may have left in the account. Since executives are involved, concise and honest updates are essential. As part of a customer journey, I like to outline a communication plan and set expectations early. This plan includes a chapter on communication across internal teams to develop a game plan for working with the customer.

Success story: I had an over-zealous customer who was drowning in details. In the prototype phase, all of the available data was enticing to them, but in production, this focus on every little detail resulted in slow response times and frustrations across the user base. I restored harmony by working with the customer to take only the required details into consideration. The business value was not diminished, the users could actually find what they wanted, and the executives saw how we captured the expected value. To avoid deja-vu, I updated our knowledge base to help our team and our partners to avoid similar issues in the future.

RECOVER

When the sales team worked with the customer to define the business goals and timeline, the customer may have been overly optimistic about what they could achieve. If lower goals or a longer time-to-value still create a positive return on investment, adjusted expectations may be all this customer needs. If I experience more than a few of these, especially if they are coming from the same rep, I work with Sales to refine the account qualification process. Success stories and details on how customers are effectively using a solution can help realign sales reps with reality.

Success Story: One of our customers strongly believed that any project planned for over a year was likely to fail. Our team had planned out a very optimistic, multi-year transformation and we were losing traction with the customer. After conferring with internal project managers, we restructured the project to include multiple, shorter phases. The customer’s team relaxed, and early successes helped them regain confidence. We ended up rolling out the entire stack and had multiple extensions along the way – a win-win.

FAREWELL

“You can lead a horse to the water, but …” is a fitting catchphrase for these customers. The key to their success or failure is clearly in their own hands. Maybe the customer lost executive sponsorship for your solution, maybe their champion is not influential enough, or maybe their tools or processes are not at the required level. They may be experiencing a bad solution fit because their vision is not aligned with your actual product scope or they are in a different market and operating by a different business model. If a customer genuinely falls into this category, any resources should be spent on them with caution. If they stay, ok, if they move, wish them well.

Note: These customers are different from the innovators who challenge you to do new things and you have an agreed-upon joint roadmap to a new and hopefully brighter future. “Crossing the Chasm,” one of my favorite books, is full of great strategies on how to expand into adjacent markets in a controlled and managed fashion.

Success Story:In my interview with Lauren Costella, the VP of CS at Medrio, she described how she and her peers assess the solution fit and risk of new leads that “break the mold” and define a mitigation strategy ranging from mandatory services as part of the deal, to accepting churn without a dedicated rescue.

Leverage your Champions

Books describing business champions routinely top the New York Times Best Sellers list because we are curious to learn how some executives excel. I use the same competitive spirit within my customer portfolio to increase adoption, business value achievement and net revenue by identifying champions and pointing other customers to their achievements.

Success Story: One of my customers was “cruising along.” Good adoption, good executive sponsorship and a solid relationship. They had the potential to go from good to great, but they were hesitant to embark on an effort with (in their minds) questionable ROI.

I put them in touch with one of our champions and they witnessed first-hand what was achievable. They added premium capabilities and made our solution a reference architecture for the entire enterprise. The account value for us more than tripled over 2 years, all because of one introduction.

Here is my process for establishing a baseline, defining playbooks and identifying champions.

STEP 1: SET THE BASELINE

When I define a customer journey, I generally have a good idea what the typical customer should achieve, when, and how. It contains key milestones and dates like:

- Day 5: First login

- Day 10: Configuration complete

- Day 90: Executive Business Review (EBR) 1 – 75% of target business value achieved

- Day 270: EBR 2 – 100% of business value achieved

As you think about your own customer journey and timing, these tips can help you avoid common pitfalls:

a) Confirm the dates and goals with your high-touch and low-touch customers directly. You don’t need a fantasy league version of the best possible circumstances, but a realistic set of expectations. For tech-touch customers, provide a recommendation that sets some expectations, and encourage your customers to reach out to you if they are falling behind.

b) Over time you may find that you need to set different goals and timelines for various segments, customer sizes, and product configurations.

c) Run your program in “silent mode” for a period of time and validate your assumptions against your actual customer base. If customers aren’t following the timeline closely, it is an indication that you may need to adjust.

d) Don’t assume your customers are on track. Ideally, implement in-app telemetry that is linked to these milestones. Nothing is worse for a struggling new customer than an “Congratulations e-mail” from your marketing automation system when they are frustrated with getting even simple steps completed.

STEP 2: DEFINE THE PLAYBOOKS

Once the baseline is established, three types of customer typically surface. I call them Champions, Cruisers, and Laggards.

Champions: At the top are my dream customers: they exceed all expectations, accelerate their onboarding, use all the bells and whistles AND surpass their business value targets. These are my champions and deserve dedicated attention:

a) Celebrate their achievements as publicly as possible: press releases, keynote speaker engagements, webinars, reference calls, innovation awards. For those who cannot be named publicly, have an internal celebration to acknowledge the sponsor and other core members.

b) Synthesize their unique “essence”: Did they have a higher-level executive sponsor, are they integrated with a specific software package, or did they have a dedicated project manager? This knowledge is priceless for developing lead qualification criteria, sales plays, best practices, and success playbooks.

c) Define a reference model for other customers and users to follow. Whoever is not in your top layer may want to get there, and now your team can guide them together to win the pot of gold at the end of the rainbow.

d) Invite them to your customer council. They already pushed the boundaries of your solution and were ready for more. Their proposals drive innovation, and they are motivated to adopt the new capabilities. They support the marketing of these enhancements as vocal advocates.

Cruisers: Hopefully the majority of your customers achieve the business value they expected within a typical timeframe. Cruisers are customers on a stable course, and they are perfect targets to connect with a Champion to drive even stronger performance.

a) Assess if the customer is able to achieve more. Maybe they have done all they can with their resources.

b) Focus primarily on maximizing the customer’s value, and explore subscription increases or new products as a secondary objective. Maximizing customer value fends off churn better than anything else.

Laggards: The third band of customers lags behind general expectations and holds the highest churn risk. How to rescue customers in distress is a separate discussion and worth its own future blog post.

STEP 3: SEGMENTATION

With these playbooks in hand, I stack-rank customers along the baseline. This enables you to consider the customer’s actual status. Combined with the other segmentation of your customers, along with their business value definitions, you have the tools in place to pair like-minded customers along the same reference model.

. . . . .

Once I adopted this three-step process with my customers and had it up and running for a few quarters, I was able to embellish the customer journey and playbooks with the knowledge I gained.

A Tale of Two EBRs

How to orchestrate the ideal EBR and what not do do.

CSPI Excellence Blog – Genshin Maruta @ Abeja

Today’s blog post features Genshin Maruta, the Head of Customer Success for Abeja in Japan. With the help of Hiroko Otsu at Success-Lab Japan, who extended the 2018 survey to Japan, he was able to measure his performance and achieved one of the highest CSPI benchmark scores and Net Revenue Retention rates. Congratulations to Gen and his team!

CSPI Excellence Blog – Sue Farrance @ Signable

Sue Farrance, teh head of CS @ Signeable, shares how she achieved Customer Success excellence through strong internal alignment, adaptable playbooks and intuitive onboarding.

CSPI Excellence Blog: Lauren Costella @ Medrio

Lauren Costella, VP of CS @ Medrio, achieved the highest CSPI score and one of the highest NRR rates. Here are some glimpses into Medroi’s exceptional Customer Success program.

2018 CSPI™ Benchmark Survey

Over 100 companies participated in the global 2018 CSPI Benchmark Survey and established a reference baseline for operational performance measured by Net Revenue Retention (NRR). It also established the high correlation between high NRR and high scores in the CSPI framework, proving the relevance of the framework as an operational guide for Customer Success leaders.

Customer Success with WorkRails

Service delivery has changed in the world of SaaS and requires new ways to manage, deliver and monetize services.